tn franchise and excise tax exemption

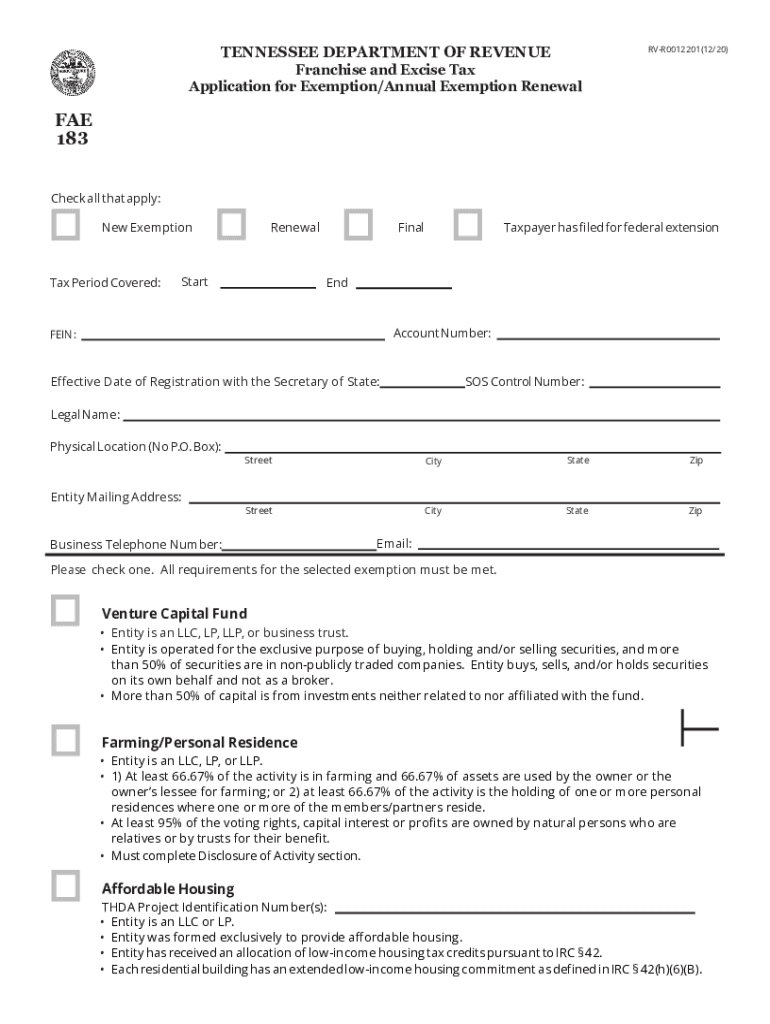

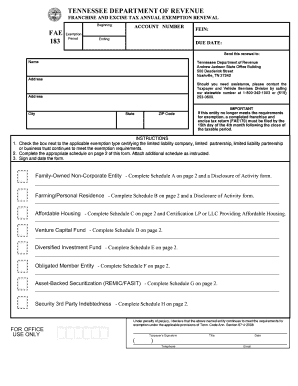

Thank you for submitting your Franchise and Excise Tax Annual Exemption Renewal FAE 183 online at Tennesseegov. Important Notice 09-05 Annual Renewal of Franchise and.

S A L T Select Developments Tennessee Baker Donelson

FONCE-5 - The Definition of Passive Investment.

. 67-4-2008a11 is made. Your confirmation details are below. Franchise.

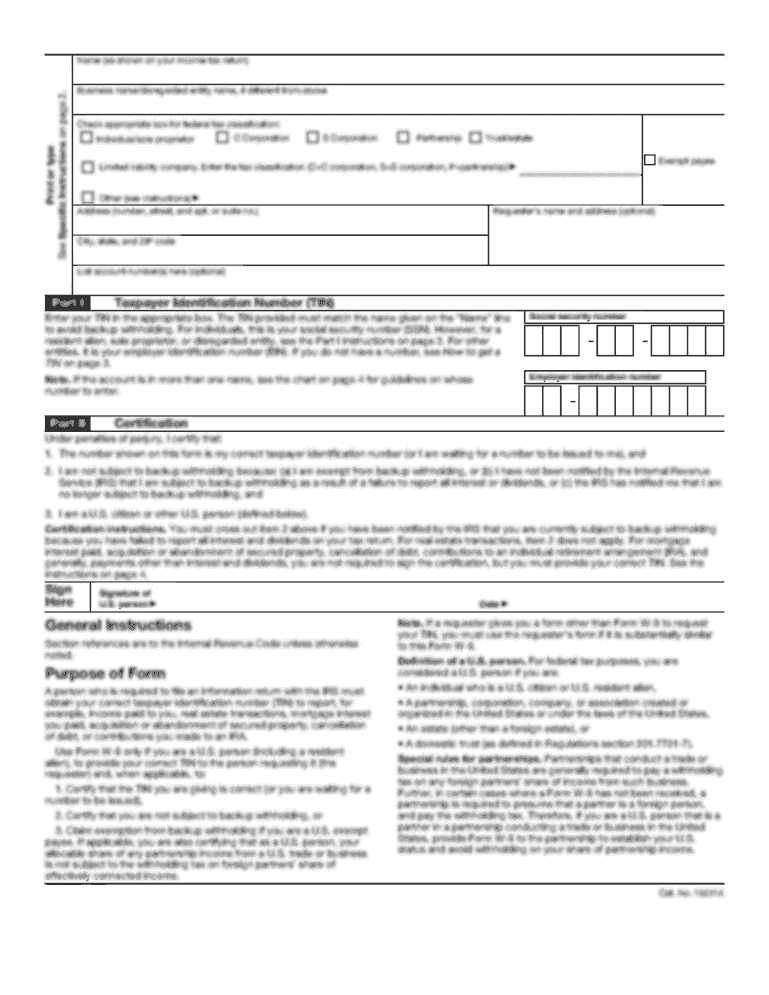

A completed franchise and excise tax return FAE170 must be filed electronically with a minimum 100 payment of any taxes due by the 15th day of the fourth month following the. Who is exempt from franchise and excise tax in Tennessee. Essentially the determination of whether the Taxpayer is exempt for Tennessee franchise and excise tax purposes pursuant to TENN.

The excise tax is based on net earnings or income for the tax year. Family-owned noncorporate entities FONCEs. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing.

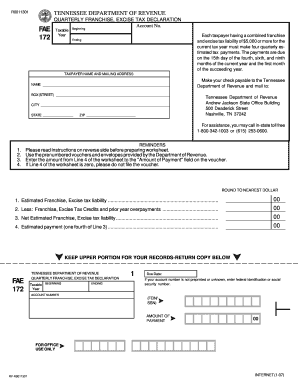

To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited liability company limited liability partnership limited. Tennessee Department of Revenue. Franchise Excise Tax - Excise Tax.

All entities doing business in Tennessee and having a substantial nexus in. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business. A completed franchise and excise tax return FAE170 must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the.

FONCE-3 - Entity Types That May Qualify for the FONCE Exemption. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. A franchise and excise tax credit is available for tax years beginning on or after July 1 2021 for qualified payroll expenses incurred by taxpayers engaging in qualified productions in.

FE-5 - Due Date for Filing Form FAE170 and Online Filing. Download or print the 2021 Tennessee Form FAE-183 Franchise and Excise Tax Annual Exemption Renewal for FREE from the Tennessee Department of Revenue. Download or print the 2021 Tennessee Form FAE-CertHousing Certification - Franchise and Excise Tax Exemption for FREE from the Tennessee Department of Revenue.

FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership. FONCE-4 - The FONCE Exemption When No Income Was Generated. Tennessee Code Annotated Section 67-4-2008 provides exemption from Tennessees Franchise and Excise Taxes under certain situations.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The excise tax is based on net earnings or. The form on the reverse side should be completed.

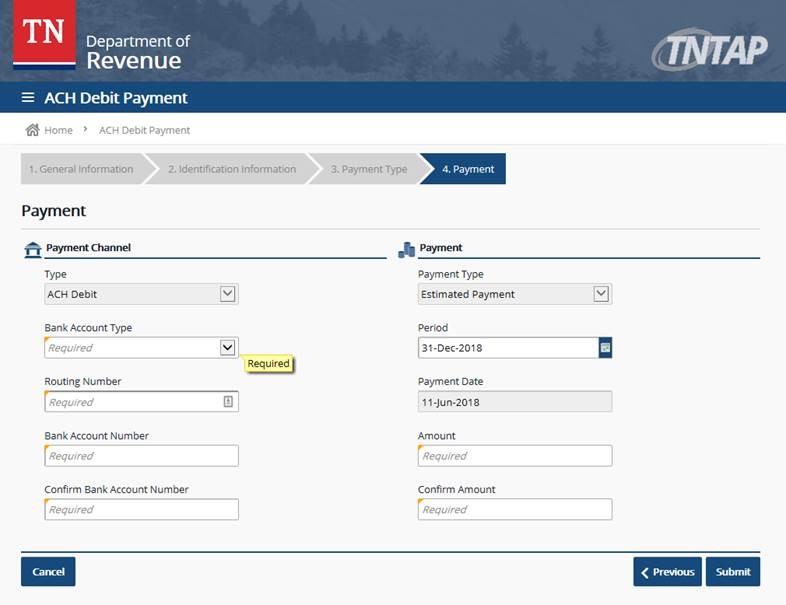

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fillable Online Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fax Email Print Pdffiller

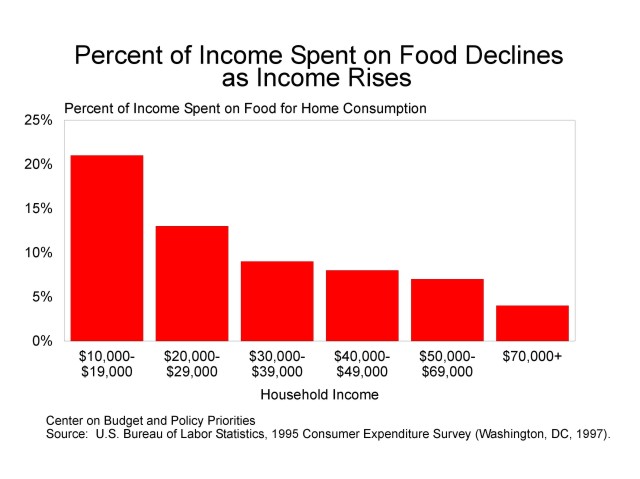

Analysis Of Tennessee Gov Sundquist S 3 29 99 Tax Proposal 4 1 99

Michael T Odom Cpa Fouts Morgan Cpas August 26 2009 Ppt Download

Tennessee Cpa Journal July August 2015 Page 32

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Printable Tennessee Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Fae 170 Fill Out Sign Online Dochub

![]()

Tennessee Taxation Of Passthrough Entities

Fae 183 Fill Out Sign Online Dochub

Restauranteur Says Rep Hill Tax Forbearance Measure Would Be Welcome Wjhl Tri Cities News Weather

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee State Tax Updates Withum

Tennessee Cpa Journal July August 2022

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

Tennessee Department Of Revenue How To File Professional Privilege Tax In Tntap Facebook By Tennessee Department Of Revenue Professional Privilege Taxpayers Now Have Until The End Of June

Nashville Attorneys Esports Intellectual Property Business Entertainment H G Llp